Currents: Against Wind and Water

AS CLIMATE CHANGE BRINGS MORE INTENSE HURRICANES AND HIGHER SEAS, HOMEOWNERS STILL HAVE OPTIONS THAT CAN HELP TO REDUCE THE RISK OF PROPERTY DAMAGE.

Allison Fisk has served as a science communicator with North Carolina Sea Grant during the past year. She graduated with her master’s in technical communication from NC State in May.

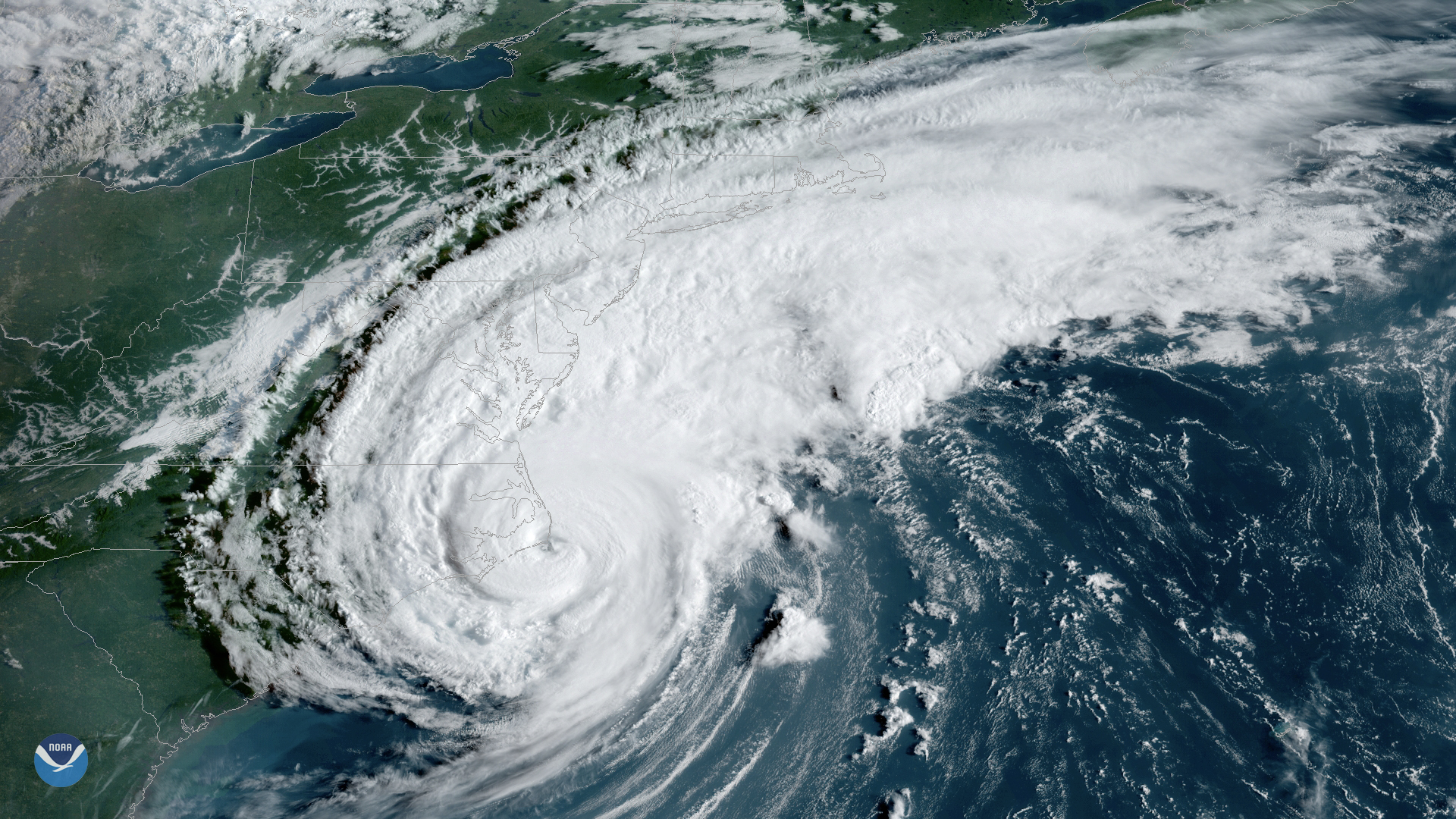

Recent storms have brought costly impacts from wind, rain, and storm surge. According to NOAA, damages totaled $11 billion after Hurricane Matthew, $24 billion after Florence, and $1.6 billion after Dorian. As climate change heats the Atlantic and brings rising seas, scientists project a continued increase in the frequency of intense storms and flooding.

Frank López, North Carolina Sea Grant’s extension director, says a wide array of strategies can help coastal residents buffer the effects of wind and water.

“Storm-resilient construction and nature-based approaches can serve to buy time and resist some of the present impacts of climate change, like increasing storm frequency and intensity,” López says. “Other impacts like sea level rise and tidal flooding will require coastal communities to evaluate where development occurs, siting of infrastructure and critical facilities, and how they can commit to holding the line against these climate forces.”

Among the approaches that can help homeowners reduce the risk of storm damage now is the FORTIFIED program. Spencer Rogers, North Carolina Sea Grant’s coastal construction specialist, says the program also can bring homeowners annual savings of 5% to 22% on wind insurance premiums.

“Installing wind-resistant features can protect buildings and potentially save homeowners money,” Rogers says. “Options to receive insurance rate credits for these protections are available through private insurance companies and state-mandated wind pools.”

The first of several increasing discounts comes with a FORTIFIED roof that requires an added water-resistant layer under your roofing, along with potential upgrades in how the roof is attached to the rest of the house.

“Following the FORTIFIED program makes homes more resilient and durable, helping homeowners protect what is priceless during a disaster,” says Cheryl Piner, an engineer and FORTIFIED evaluator. She says that the underlayer beneath the shingles on FORTIFIED roofs helps to prevent damage from high winds knocking off shingles and then allowing rainwater into the house.

“I witnessed extensive damage to homes on Topsail Beach after Hurricane Florence,” Piner says. “The homes were effectively flooded from water coming in from the roof, which then required full gutting and rebuild for the interior of the homes.”

FORTIFIED roof inspectors verify modifications before the insurance incentives kick in. The cost for the evaluations and inspections as a FORTIFIED roof is installed is about $600. Rogers says the up-front cost is relatively small, though, compared to the cost of damage — and, he adds, the insurance companies offer incentives that pay toward this cost.

A BETTER ROOF ON THE OUTER BANKS

Barrier island resident Sara Mirabilio received a letter in April 2019 from the North Carolina Insurance Underwriting Association (NCIUA), better known as “the state wind pool,” inviting homeowners to apply for a firstcome-first-serve grant for replacing roofing with a FORTIFIED Roof.

“My roof was 17 years old, and I already was considering replacing it,” says Mirabilio, a fisheries specialist based on the Outer Banks with North Carolina Sea Grant.

After she applied for a grant, Mirabilio received $6,000 toward the $8,500 cost of the FORTIFIED roof for her 1,172-square-foot home. Although that roof was more expensive than a standard roof replacement, with the grant she paid less overall.

“I love my new roof,” Mirabilio says. “You can’t even see where the old vents were. It was cheaper with the grant, I got an insurance discount, and it’s a better roof.”

For six years, Mirabilio will get an insurance discount for her FORTIFIED roof. She receives a residential windstorm mitigation credit of over $90 per year from the NCIUA, the policy she had at the time of the install. After switching to another insurer, Mirabilio continues to receive a wind loss reduction credit of just over $90.

In 2021, some N.C. coastal homeowners have qualified for a new grant program for FORTIFIED roofs.

FORTIFIED HABITAT

FORTIFIED Roofs aren’t only available for existing homeowners but for new builds, too.

Twenty years ago, Habitat for Humanity partnered with Nationwide Insurance to build the highest level FORTIFIED for Safer Living Home. In addition, Cape Fear Habitat has been using water-resistant roofing methods since 2008, even before the FORTIFIED discounts became available, helping protect over 150 homes.

This kind of building is not new to North Carolina or Habitat for Humanity, and, in fact, it fits with Habitat’s process of sturdy construction.

“Houses built by Habitat for Humanity are durable, because those homes typically are built by teams of volunteers who like to drive nails,” Rogers says. “Structural wind resistance is most often controlled by the connections, such as nails or screws — and more volunteers use more fasteners.”

In 2019, Spencer Rogers suggested the University of North Carolina Wilmington Women Build team, led by Katherine Montwieler, work with Habitat on a FORTIFIED home build.

Rogers arranged for the materials to do the roofing work as a demonstration, and Piner donated her time for the required FORTIFIED evaluations for the Women Build team.

Montwieler’s Women Build team raised about $5,000 for Habitat for Humanity in 2018 and $4,000 in 2019. She says she saw the new construction as an opportunity to show “the campus and the wider audience the great work we can do together.”

With Habitat and UNCW Women Build teaming on construction, and with Piner’s evaluation, the house received a FORTIFIED Roof certificate, qualifying its resident for wind insurance premium discounts.

Not only do these provisions help to make homes more durable during the hurricane season, but also year-round from tornadoes, severe thunderstorms, and nor’easters.

“The program also helps homeowners lower the overall cost of their community’s recovery after a disaster,” Piner says. “Studies have shown every $1 spent on disaster mitigation saves $4 in community disaster recovery expenses.”

North Carolina Sea Grant has helped to train building evaluators, roofers, and contractors on the FORTIFIED requirements. Rogers also provides information to homeowners about the insurance incentives available to them — including those discounts on wind insurance premiums that can save up to 22% annually.

He also offers this simple advice: “Ask your insurance agent for details.”

MORE

- 2021 Memo from Spencer Rogers on “Insurance Premium Incentives for WindResistant Construction”

- Video of Testing of a FORTIFIED Home vs. a Regular Home

- Critical Steps to Avoid Roof Damage from Tornadoes and Hurricanes

- NOAA on Cost of Hurricanes Matthew, Florence, and Dorian

- FORTIFIED’s Incentives

Lead photo: Oak Island in 2020, after Hurricane Isaias. Credit: Ken Blevins/StarNews.

- Categories: